Led B2C and B2B product design for a suite of applications

Customer loan portal and communication interfaces to internal loan review, officer and broker management, task coordination, and underwriting tools.

Company: Interfirst

Back to home page | View all portfolio items

Company function: Florida state’s largest health insurer.

Company type: Small enterprise

Company website: https://www.interfirst.com/

My roles: UX product designer | Visual designer

Team involved: 1 interaction designers | 2 project managers | 1 lead developer

Tools: Figma | Adobe xd | Invisionapp | Balsamiq

Duration: 2 years

Key contributions: Research & concept creation | Wireframing & prototyping | Interaction & experience design | Visual design

Project Overview

Pain Points: Applicants struggled with an overly complex unintuitive questionnaire that drove a 40% drop off rate and a lengthy multi step loan process lacking clear guidance, leading to frustration and abandonment. Internally the company relied on a third party app to manage loan officers and brokers, resulting in fragmented workflows, and lacked an in house staff management system, which hindered scalability and centralized control.

Goals & Objectives Overview: Our goal was to streamline the borrower application journey with a clear guided questionnaire and simplified multi-step process to improve completion rates, while creating a robust in-house portal for managing loan officers and brokers to replace third-party tools and centralize workflows for scalability and operational control, ultimately saving the company money in the long term and enhancing customer satisfaction and engagement to drive higher conversion rates.

Process: I began reviewing current experience in order to be familiar with the product and conduced audit to catalog major usability barriers and why this product needs redesign. Based on my research and data provided by PM, I ran several ideation workshops with product managers, developers, and leadership to prioritize key features and interactions and be aligned on proposed solution. I activity worked with hiring manager (client) to review design and interaction on weekly basis, validated design with several team members to ensure timely delivery.

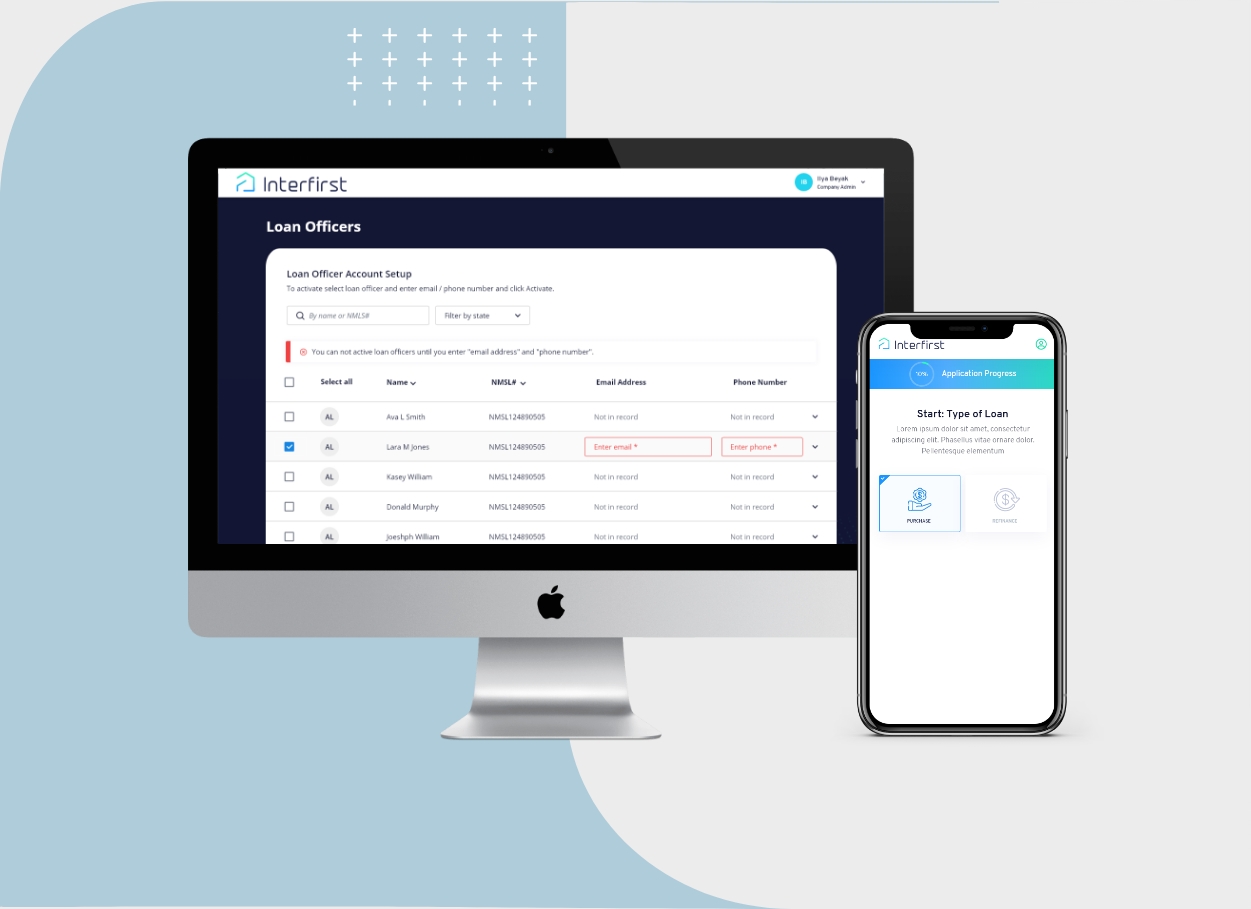

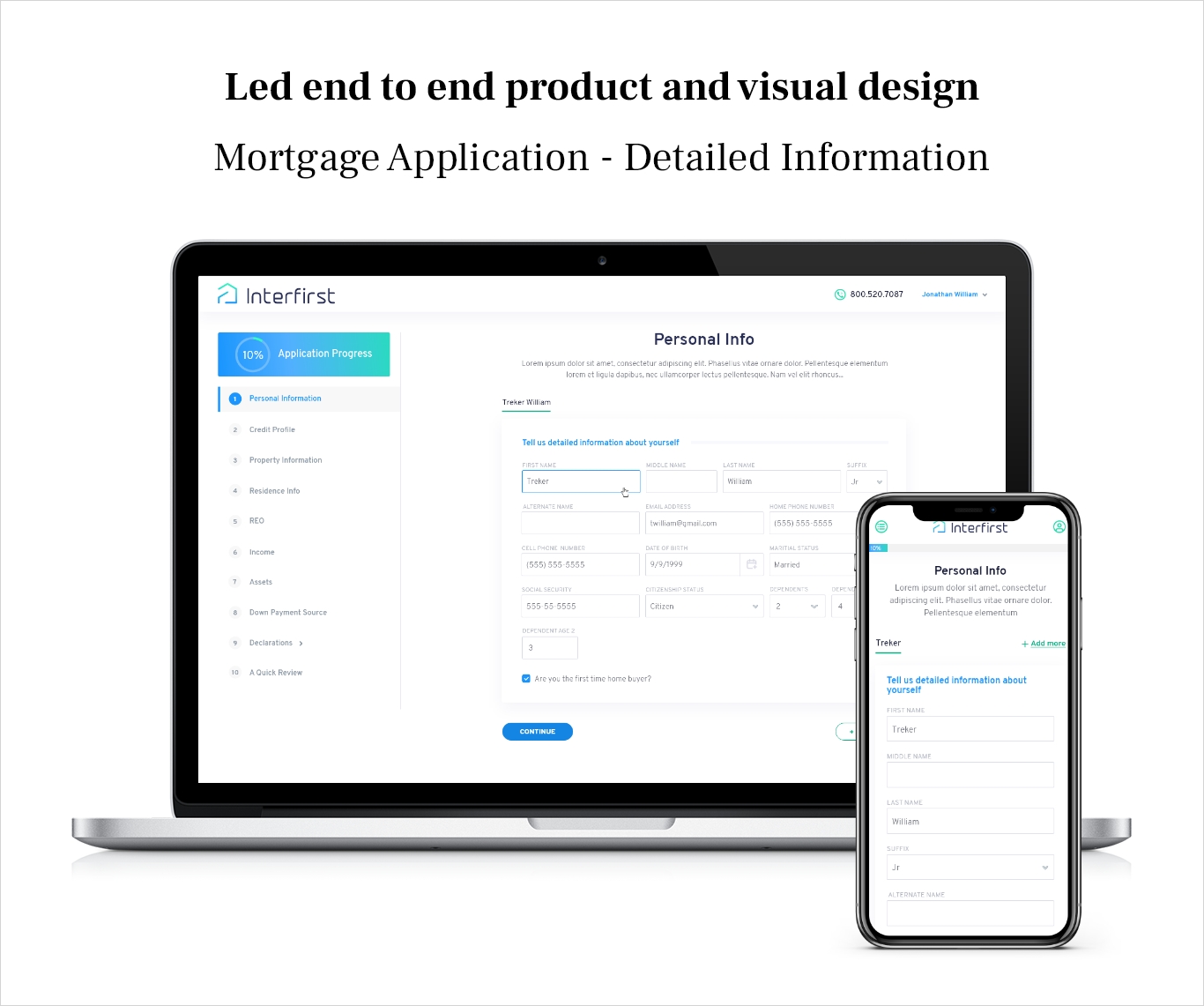

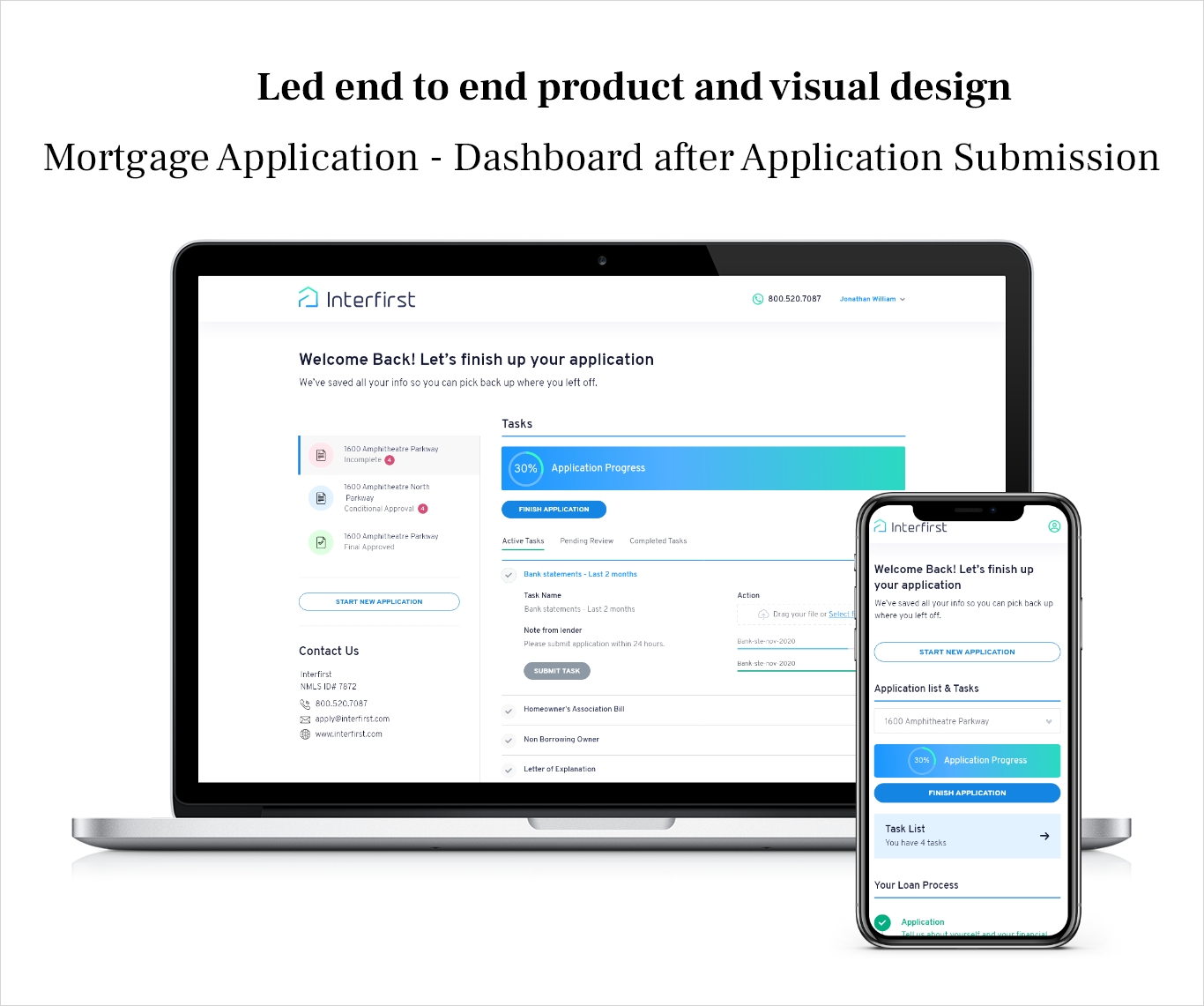

My Role & Impact: eAs an independent contractor, I led a complete UX overhaul of the loan application process, enhancing the borrower journey from initial form completion through processing and approval, and created a brand new portal for loan officers and brokers based on a detailed scope document. I redesigned the consumer application with streamlined flows and clear guidance and built an internal management interface that empowers staff to onboard and support borrowers more efficiently. The result was higher completion rates, smoother approval workflows, and a scalable platform that supports the company’s growth.

A Glimpse into My Work

I led end-to-end design for:

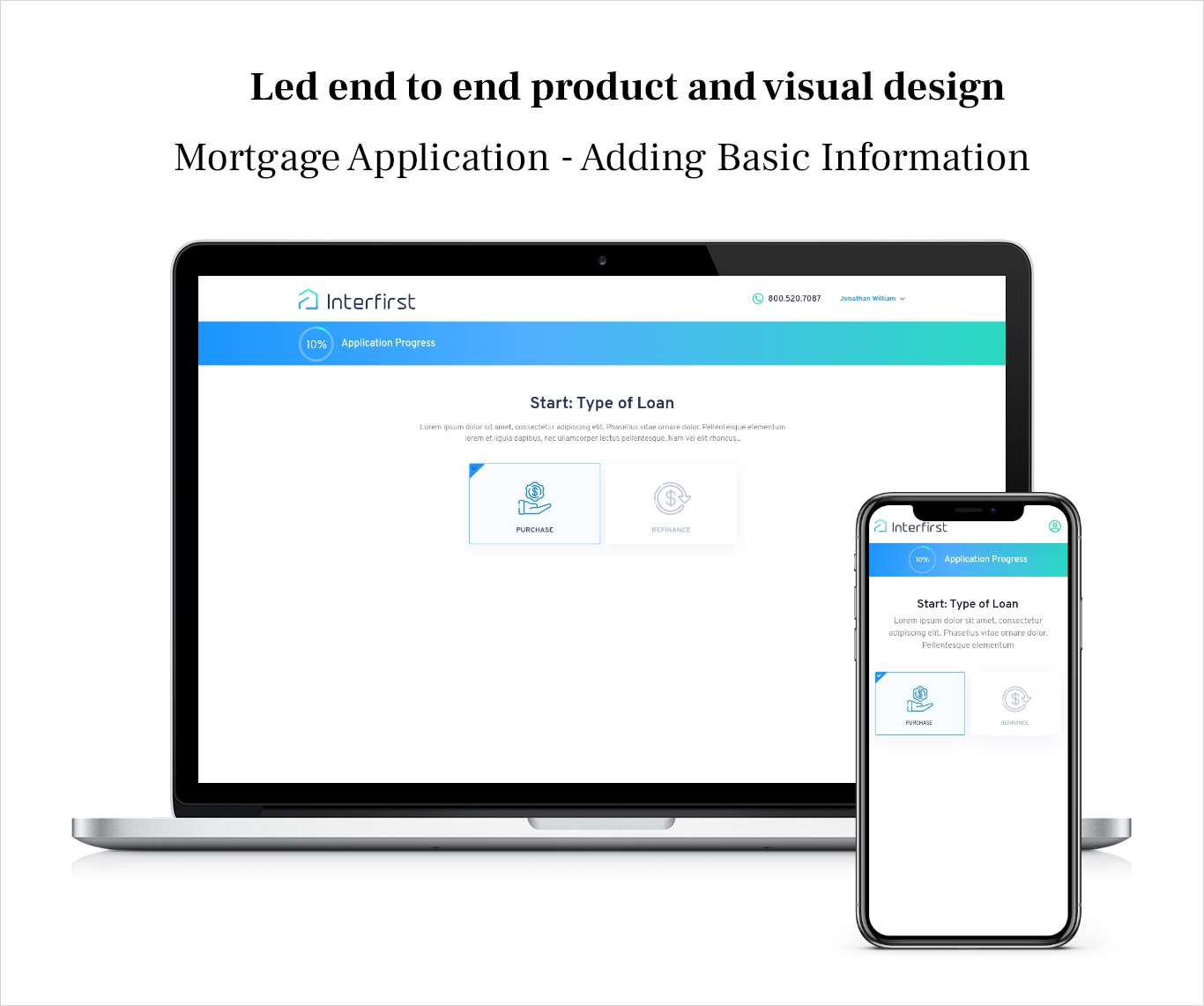

The DSCR loan flow (purchase and refinance).

Customer application detail and post-submission dashboard flows.

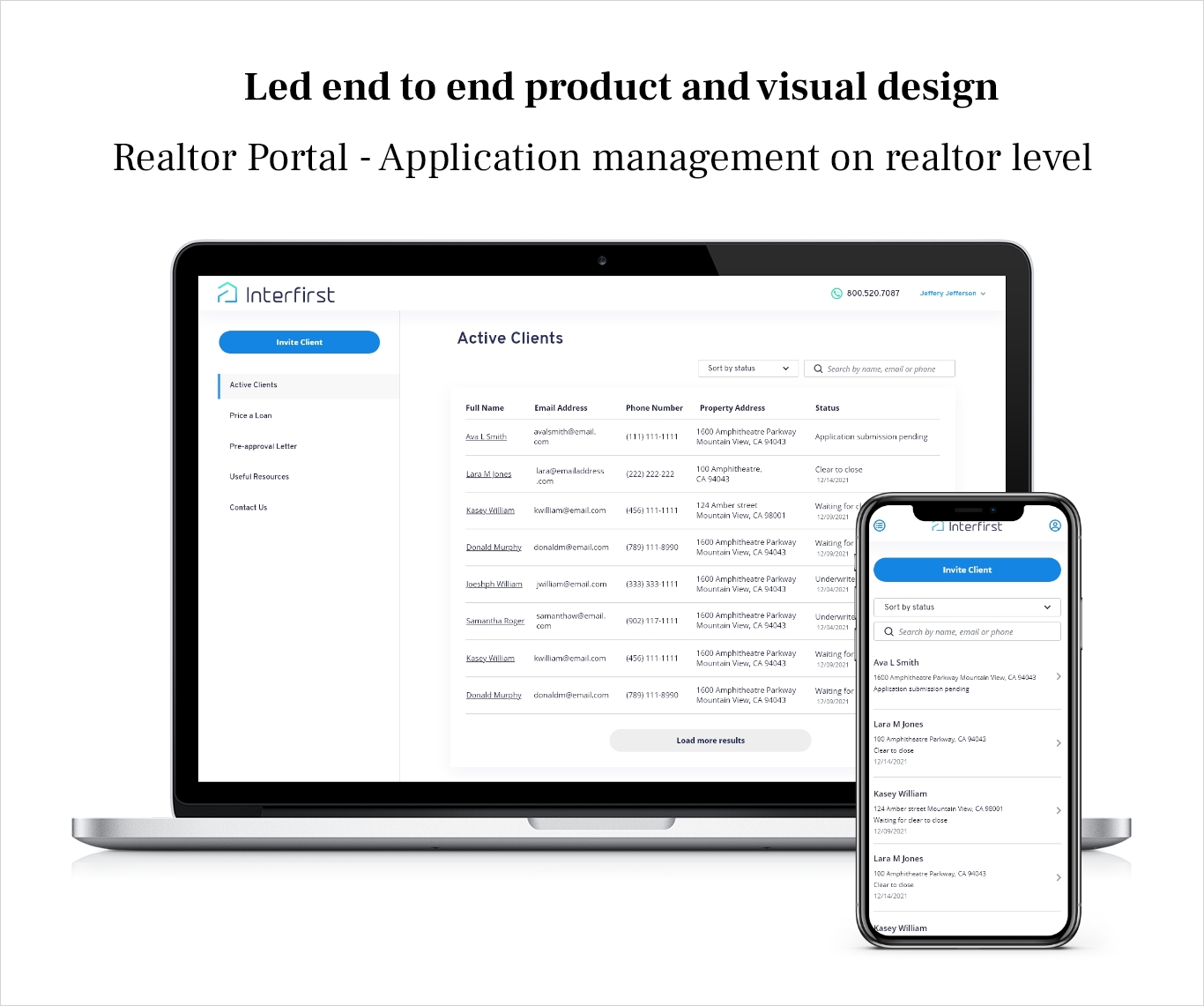

Agent flow for managing client applications and issuing pre-approval letters.

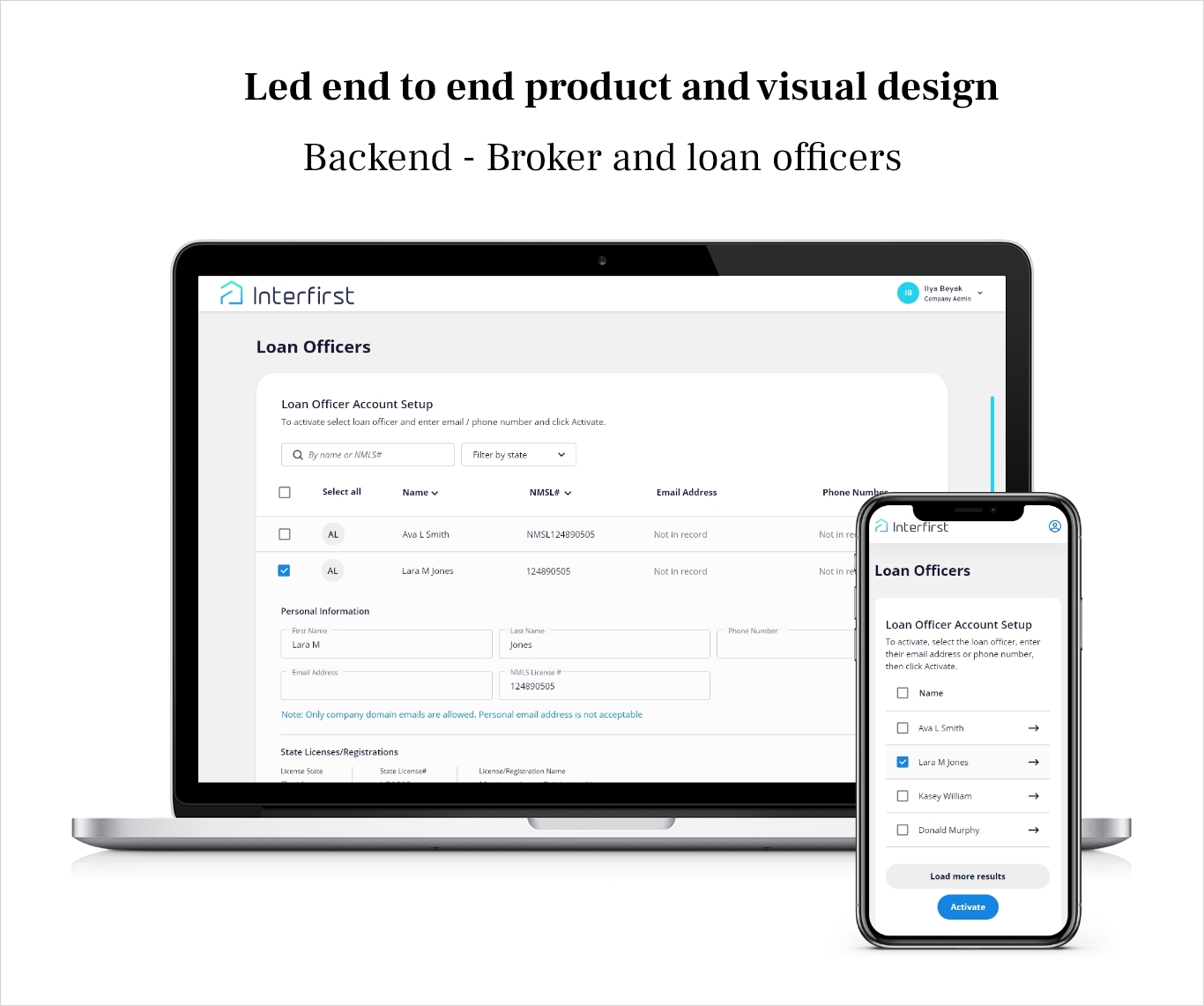

Broker flow for adding, editing, and removing loan officers.

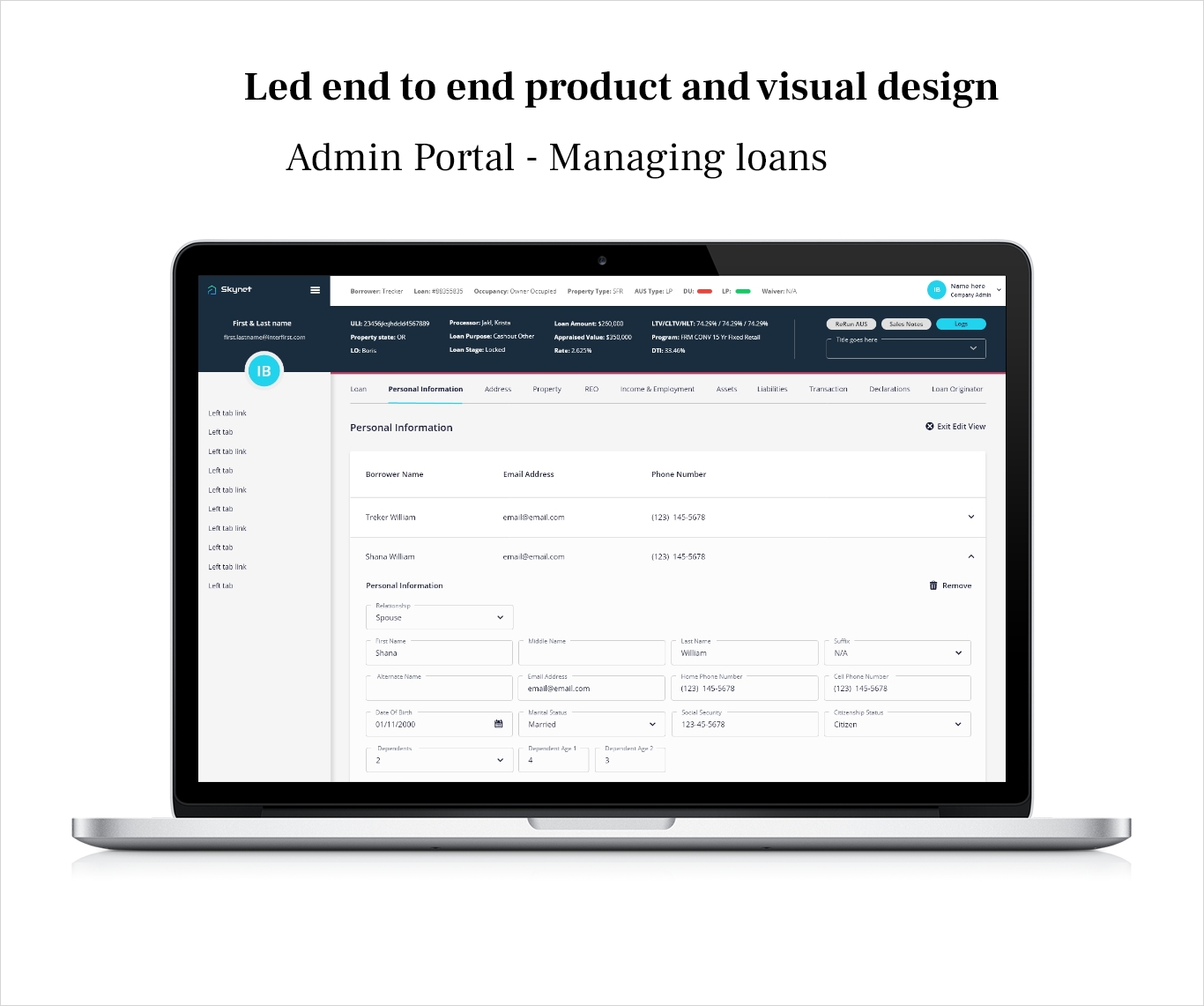

Admin dashboard enabling underwriters to access, review, and approve full loan applications.

Takeaways

Streamlined Application Flow:

A clear, guided questionnaire and simplified multi-step process cut complexity, reducing drop-offs and significantly improving completion rates.

Long-Term Cost Savings:

Automating processes and consolidating systems eliminated ongoing third-party fees and reduced operational overhead, delivering measurable long-term savings.

Centralized In-House Portal:

Replacing third-party tools with an internal management system brought loan officers and brokers onto one platform, unifying workflows and enhancing scalability.

Boosted Satisfaction and Conversions:

A more intuitive user experience increased customer satisfaction and engagement, driving higher application submissions and ultimately more closed loans.

Take your project further with human-centered design. I can help, email me at: craftedbyux@gmail.com